36+ rolling closing costs into mortgage

Apply And Get Pre Approved In 24hrs. Web On average closing costs are approximately 2 to 5 of the purchase price of the property.

Articles By Tag Real Estate Agents The Deltanet Delta Media Group S Blog

Lets say youve got 5000 in closing costs.

. Web In some cases closing costs can be as low as 1 or 2 of the purchase price of a property. Lock Your Mortgage Rate Today. Web According to ClosingCorp the average mortgage closing costs in the first half of 2021 were 3836 without taxes and 6837 with taxes.

Lock Your Mortgage Rate Today. Get Started Now With Quicken Loans. Special Offers Just a Click Away.

Get Started Now With Quicken Loans. Web Rolling your closing costs in a mortgage means adding the costs to your new mortgage loan amount. Choose Smart Apply Easily.

Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. Thus if you buy a 200000 house your closing costs could range from 6000 to 12000. Web Heres how it works.

Web In addition to saving for your down payment you need to save for closing costs too. Closing costs usually end up being about 2-5 of the price of the property. Lock Your Rate Today.

Web Closing costs arent universal. Ad Compare the Best Mortgage Lender To Finance You New Home. Ad Were Americas Largest Mortgage Lender.

If your loan amount is 100000 at the time of refinance and you want to roll your closing costs. Web Closing costs are incurred once the seller transfers the property to the buyer. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad How Affordable is a Mortgage. Compare Mortgage Options Get Quotes. Web The other option is that if the 600k house appraises for at least 618k then you roll the 18k in closing costs into the mortgage.

Ad Highest Satisfaction For No Closing Cost Mortgage Origination. Web In fact you can expect to pay around 2 to 5 of the value of the home in closing costs so thats thousands -- or even tens of thousands -- of dollars. In other caseswhen loan brokers and real estate agents are.

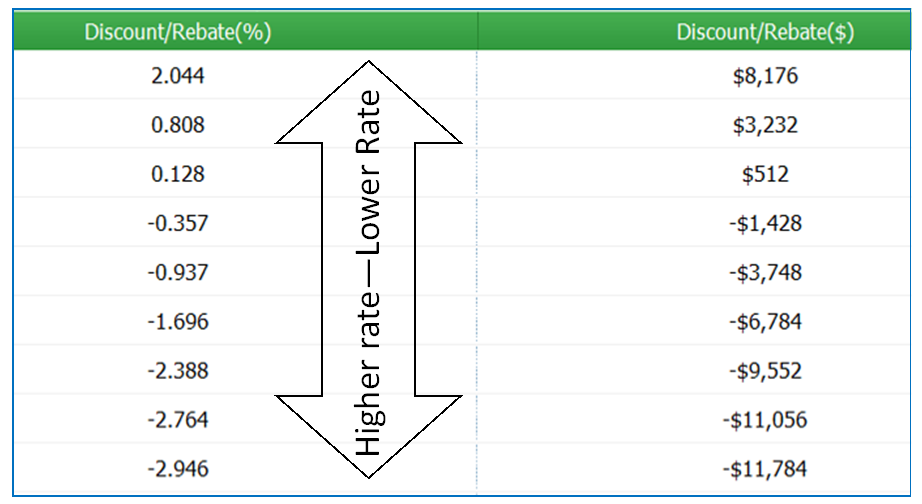

Both can give you a little break on your. The first is by taking lender credits. The Best Lenders All In 1 Place.

Low Fixed Mortgage Refinance Rates Updated Daily. In this scenario we would effectively put 48k. They can vary depending on where you live but theyre generally between 2 and 5 of the.

See If You Qualified. Web A flock of fees known as closing costs on a new home are part and parcel of a sale. Web There are two key ways to bake upfront costs into your new loan.

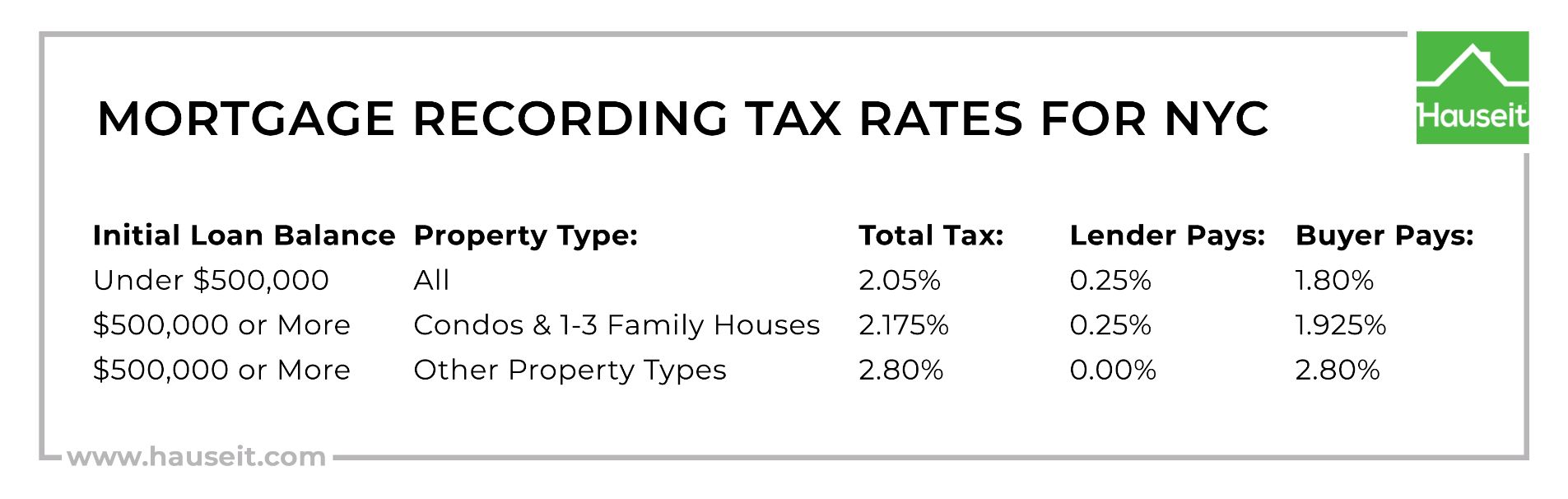

Closing costs can range anywhere from 3 6 of the price of the home. Department of Veterans Affairs VA loans Along with most applicable conventional loan fees VA loans require a funding fee. Web Closing costs typically range from 36 of the loan amount.

Ad Were Americas Largest Mortgage Lender. Web Closing costs for US. The buyers closing costs may be under 5 while the sellers closing costs.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Learn Why to Use it for Retirement. Closing costs can often be.

No SNN Needed to Check Rates. No More Mortgage Payments. Web Instead of rolling your closing costs into your mortgage you could also ask for lender credits or seller concessions.

Odds are you wont be blindsided by the. Apply Get Pre-Approved Today. Apply To Enjoy A Service.

Lowest Mortgage Closing Costs Compared Reviewed. Web How Much Are Mortgage Closing Costs. In exchange for a higher interest rate on your loan your lender will give.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. They typically range from 2 to 5 of the homes purchase price. Ad Compare Lowest Mortgage Refinance Rates Today For 2023.

Compare Mortgage Options Get Quotes. Ad Compare the Best Home Loans for February 2023. Each mortgage lender sets its own fees that are then passed on to borrowers when they finalize their home loans.

This helps to limit out-of-pocket money and leaves more cash at your. Find Out How Much You Can Afford.

Is It Smart To Roll Closing Costs Into Your Loan Csmc Mortgage

Can You Roll Closing Costs Into A Mortgage The Money Boy

How Much Is A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Mortgage Porter Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Can You Roll Your Closing Cost Into Your Mortgage Loan Youtube

Can You Roll Closing Costs Into A Mortgage The Money Boy

Is It Smart To Roll Closing Costs Into Your Loan Carol Flanagan Guild Mortgage Llc

![]()

What Are Mortgage Closing Costs Nerdwallet

Why You Shouldn T Roll Closing Costs Into Your Mortgage

Are Closing Costs Included In A Mortgage

Mortgage Closing Costs Explained How Much You Ll Pay Forbes Advisor

Mortgage Closing Costs Explained How Much You Ll Pay Forbes Advisor

Average Closing Costs In 2023 Complete List Of Closing Costs

Can You Roll Closing Costs Into A Mortgage The Money Boy

Closing Costs Calculator Nerdwallet

Calameo November 2022 Business Examiner Vancouver Island

Closing Costs Calculator Estimate Closing Costs At Bank Of America